If you want to dominate a market start by building a sales machine

I've never been fond of a team that relies on a star player to carry them forward. They may win a few games here or there, if they're lucky they'll make it to a championship but they'll never build a dynasty. The teams that become dynasties do not rely on a key person for performance. Dynasties are machines. They are driven by clear and focused processes, principles, and proven strategies to deliver success consistently and sustainably. People from the outside may think it's luck or try to simplify their success. "It's just because they did X" or "We'll it's really all just because they have Y on the team". The reality is what they've built is a machine that is greater than any one person and is carefully designed to engineer success.

Building a market-dominant, growth-oriented business is just the same. Nearly every business that has achieved this has been structured that way. Not one of them has a sales strategy that consists of "Oh we have this one sales guy who's just phenomenal". There's nothing wrong with good salespeople, but even the best of them are still operating with 24hour days. What happens if they leave tomorrow? Does you're success go with them?

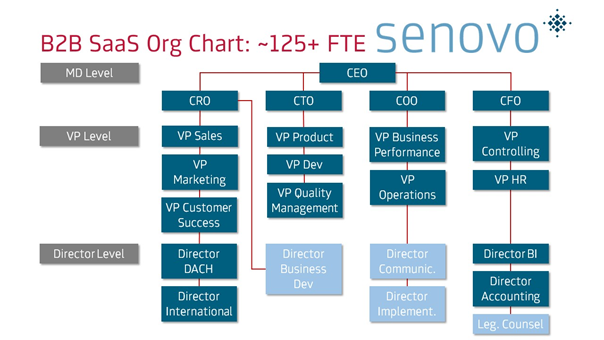

I was on a call the other day with a leadership team talking about changing their approach to marketing and sales. To their credit they realized that just having a good brand and waiting for the phone to ring was not going to drive the growth they're looking for. The challenge was that their initial plan was to split the time of various division managers so they would spend half their time on sales and the other half running their divisions. So I shared with them the following org chart of a theoretical B2B SaaS company for contrast.

Devoting a portion of one person's time for all sales functions was not going to get them very far. In a B2B SaaS environment they actually dedicate not just a single person but entire departments to individuals stages in the sales funnel. Think about that in contrast... which company is better positioned for growth?

Now that's a bit of an extreme example and you might be saying "Well that's not us. We have sales team, we have a marketing department." Sure but that's not enough either. To truly scale a company, to drive an order of magnitude shift in growth, requires a totally new level of sophistication compared to just doing more of the same sales activities.

A sales machine operates just like any other machine. Machines have a well defined purpose and the most efficient ones have a single purpose. Machines have an engineered process that runs just the same no matter who the operator is. Machines are driven by predictable numbers; so many inputs results in so many outputs. You run the machine for X hours to get Y number of outputs. There's no guesswork, there's not serendipity, there's total control over your outcomes. That is what we strive for in a sales and marketing organization if you want to truly drive growth and market dominance. You can essentially reduce all of the people and activities down to a mathematical model and show how investments in those resources results in revenue increases over predictable time periods.