On January 20, 2025, the release of DeepSeek R1 (a new AI model developed by a Chinese company) sent markets reeling. Markets reacted with a sharp decline in the stock prices of major US tech companies, particularly NVIDIA, due to concerns that DeepSeek’s cost-effective open-source design could disrupt the established AI market dynamics, potentially rendering large investments in expensive AI infrastructure less necessary and bringing into question the dominance of US tech giants in AI.

As AI reshapes industries, the AI investment landscape is also evolving. Given the shifting dynamics, a nuanced, segmented, and flexible strategy is needed for allocators in 2025. How should allocators balance investments across chips and hardware, data centers and infrastructure, energy, and AI applications? To answer that, it’s important to understand the three dimensions driving AI advancement.

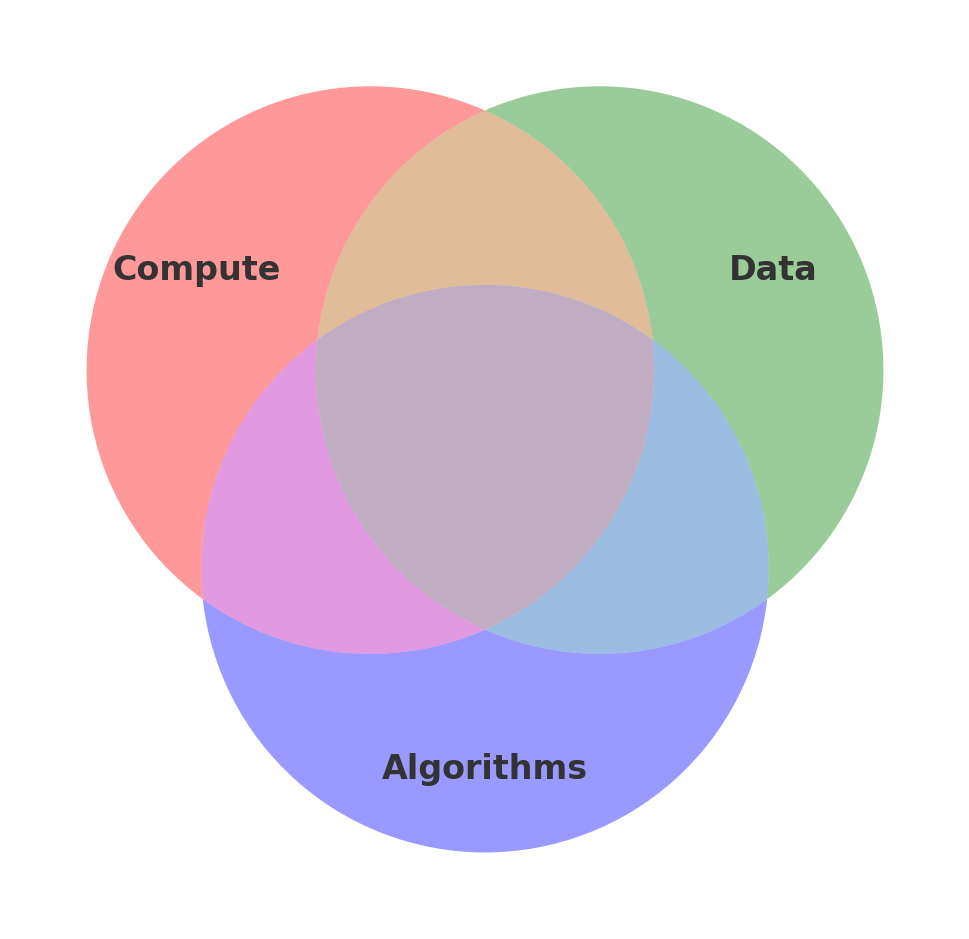

Every player in AI needs to differentiate its offerings from competitors. There are three broad means to achieve better AI performance: compute power (chips, servers, and data centers), data upon which to train the AI models, and algorithms which define how the AI learns and what it can do with what it has learned. Here are some trends to watch in each of these areas:

Compute Trends

Many assumed that scaling compute was both necessary and sufficient for improving AI models. DeepSeek shook this assumption, showing that advanced algorithms can significantly reduce the cost of training and deploying a new model, without sacrificing performance. However reduced costs will likely only increase demand (Jevons paradox), as demand for AI seems insatiable. GPUs still dominate (and NVIDIA dominates in the category), but special-purpose AI chips are on the rise. These specialized chips will further improve speed, power efficiency, and cost-effectiveness.

Furthermore, AI inference is expected to increasingly shift from centralized data centers to edge devices smartphones, IoT, robotics) over the next few years. Lower latency, improved privacy, and reduced bandwidth requirements make on-device AI compelling.

Data Trends

AI-generated synthetic data will help overcome the limitations of real-world datasets (cost, privacy, scarcity). This approach can accelerate model development, especially in highly regulated domains (healthcare, finance). Self-supervised learning (such as used in Google DeepMind’s Alpha Fold) allows models to learn from unlabeled data, reducing dependency on human annotation. Companies with proprietary data sets will still enjoy a competitive advantage for a time.

Algorithm Trends

While large foundation models (e.g., chatGPT, Llama, Claude) remain influential, the trend is also moving toward smaller, domain-specific models that are cheaper to train and deploy. As in the case of DeepSeek, a Mixture-of-Experts algorithm can give better results with a smaller-sized model. Further, model compression via pruning, quantization and knowledge distillation helps maintain performance while reducing compute costs.

AI agents (e.g., OpenAI’s “Operator”) are designed to plan and execute tasks autonomously. Though early reviews have been mixed, improvements in reinforcement learning and planning algorithms will likely make agent-based AI more reliable and commercially viable.

Ultimately, advances in compute, data, and algorithms reinforce one another, leading to a more ubiquitous and powerful AI ecosystem. This convergence paves the way for AI’s expansion into new industries—healthcare, finance, logistics, energy, government, and more.

Key Considerations for Allocators

Allocator Recommendations for 2025

Conclusion

The AI investing landscape is dynamic, with increased investment activity, and evolving strategies among both established players and emerging startups. Allocators need to adopt a flexible, segmented strategy, balancing exposure to chip and infrastructure giants with investments in nimble, innovative application-focused companies. A close eye on valuation and a focus on defensible economic fundamentals are crucial. As the AI landscape continues to evolve, continuous monitoring and agile rebalancing will be key.

About the Author

Chuck Stormon has been a thought-leader in AI for 40 years and has seen many hype-cycles and winters. He has built eight companies, including developing one of the first AI accelerator chips and many AI applications. For the past dozen years, Chuck and his partners at StartFast Ventures have invested in high-growth AI application companies. chuck@startfastventures.com